Stop payment letter to bank format in word

Table of Contents

Table of Contents

Are you in a situation where you need to cancel a payment on a cheque, but you’re not sure what steps to take? Don’t worry; a stop payment letter can solve your problem. This letter is a document that instructs the bank to stop payment on a cheque that has already been issued. With a stop payment letter, you can avoid paying fees associated with bounced cheques or fraud.

Issues You Might Be Facing Without Stop Payment Letter Format

Have you ever written a cheque, only to realize later that you don’t have enough funds in your account to cover it? Alternatively, have you ever received a cheque from someone and found out that it’s fraudulent? In both cases, the bank may charge you a fee for bounced cheques or insufficient funds. Moreover, it can be challenging to recover lost funds, especially if the cheque is fraudulent.

What is Stop Payment Letter Format?

A stop payment letter is a formal letter that you write to a bank instructing it not to honor a specific cheque. When you send a stop payment letter to your bank, the bank will put a stop on the cheque before it is processed. Your bank may charge you a fee for this service, but it’s usually less expensive than bouncing the cheque and incurring additional fees.

Benefits of Using Stop Payment Letter Format

By using Stop Payment Letter Format, you can avoid fees associated with bounced cheques and fraud. If you write a cheque and later realize it will bounce, you can prevent it from happening by sending a stop payment letter. Additionally, if the cheque is lost or stolen, you can use a stop payment letter to prevent someone from cashing it.

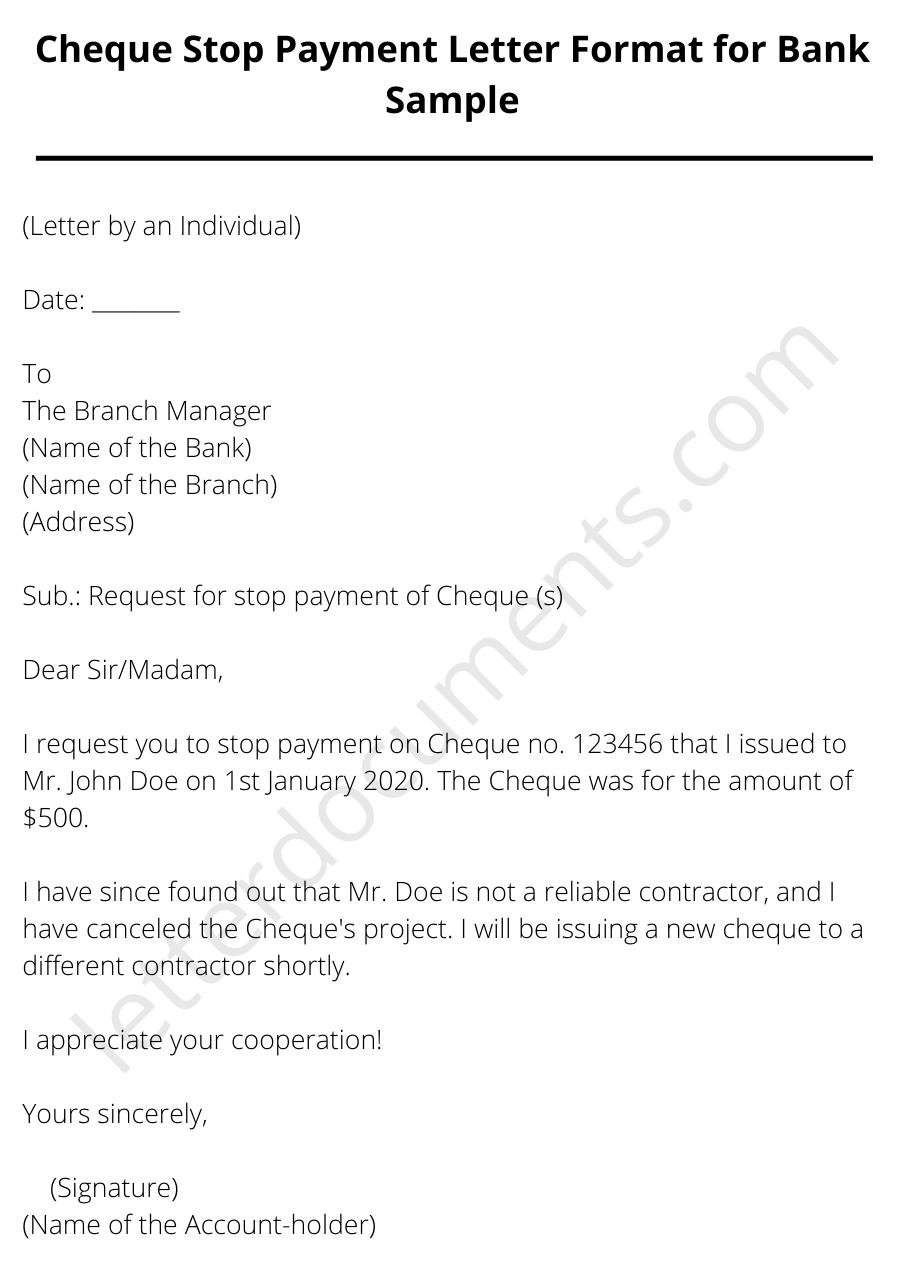

Explaining Stop Payment Letter Format

When it comes to stop payment letter format, there are specific guidelines you should follow to ensure the letter is valid. The letter should state clearly your account number, the recipient’s name, cheque number, date, and the amount of the cheque. It would be best if you also mentioned why you are stopping the payment. A sample Stop Payment Letter Format is available online.

How to Address a Stop Payment Letter?

How to Address a Stop Payment Letter?

When it comes to addressing a stop payment letter, start with your name and address in the top left corner of the letter. Below that, you should include the recipient’s name and address. Use a formal tone throughout the letter, and make sure it’s clear and concise. The stop payment letter should be sent via certified mail to ensure that the bank receives it, and you have proof of delivery.

### Stop Payment Letter Format Vs. Stop Payment Order

### Stop Payment Letter Format Vs. Stop Payment Order

While Stop Payment Letter Format is a written instruction to the bank to stop payment on a cheque, a stop payment order is usually given by a court. A stop payment order can prevent a bank from debiting funds from a specific account in favor of a creditor. In contrast, a stop payment letter only applies to a single cheque.

How to Adhere to Stop Payment Letter Format?

While writing a stop payment letter, be specific about the cheque number, the amount, and the payee. Also, give the reason for stopping it. The bank uses this information to locate the cheque and prevent it from being paid. Moreover, if you know the cheque was forged or stolen, you should file a police report and give them a copy of the stop payment letter.

When Should You Write a Stop Payment Letter?

When Should You Write a Stop Payment Letter?

The most common situation when you should write a stop payment letter is when you realize that a cheque you’ve issued will bounce. Additionally, if you issue a cheque and the payee loses it or you suspect that it’s been stolen, you should write a stop payment letter. If you fail to stop the payment on a fraudulent cheque, you may be liable for the amount of the cheque, and you won’t be able to recover the funds easily.

Question and Answer About Stop Payment Letter Format

Question and Answer About Stop Payment Letter Format

Q1. What happens when you write a stop payment letter?

When you write a stop payment letter, you instruct the bank not to honor a specific cheque you’ve issued or received.

Q2. Can I stop payment on a cheque that hasn’t been issued yet?

No, you cannot stop payment on a cheque that hasn’t been issued yet.

Q3. How long does it take for a stop payment request to take effect?

It usually takes one business day for a stop payment request to take effect.

Q4. Can I cancel a stop payment request?

Yes, you can cancel a stop payment request if you find the lost cheque or if you have sufficient funds in your account to cover the payment.

Conclusion of Stop Payment Letter Format

Stop payment letter format is a simple yet essential document everyone should be familiar with. It can help you avoid fees associated with bounced cheques and fraud. Whether you’re dealing with a lost or stolen cheque or one with insufficient funds, a stop payment letter can help you control the situation and prevent further problems.

Gallery

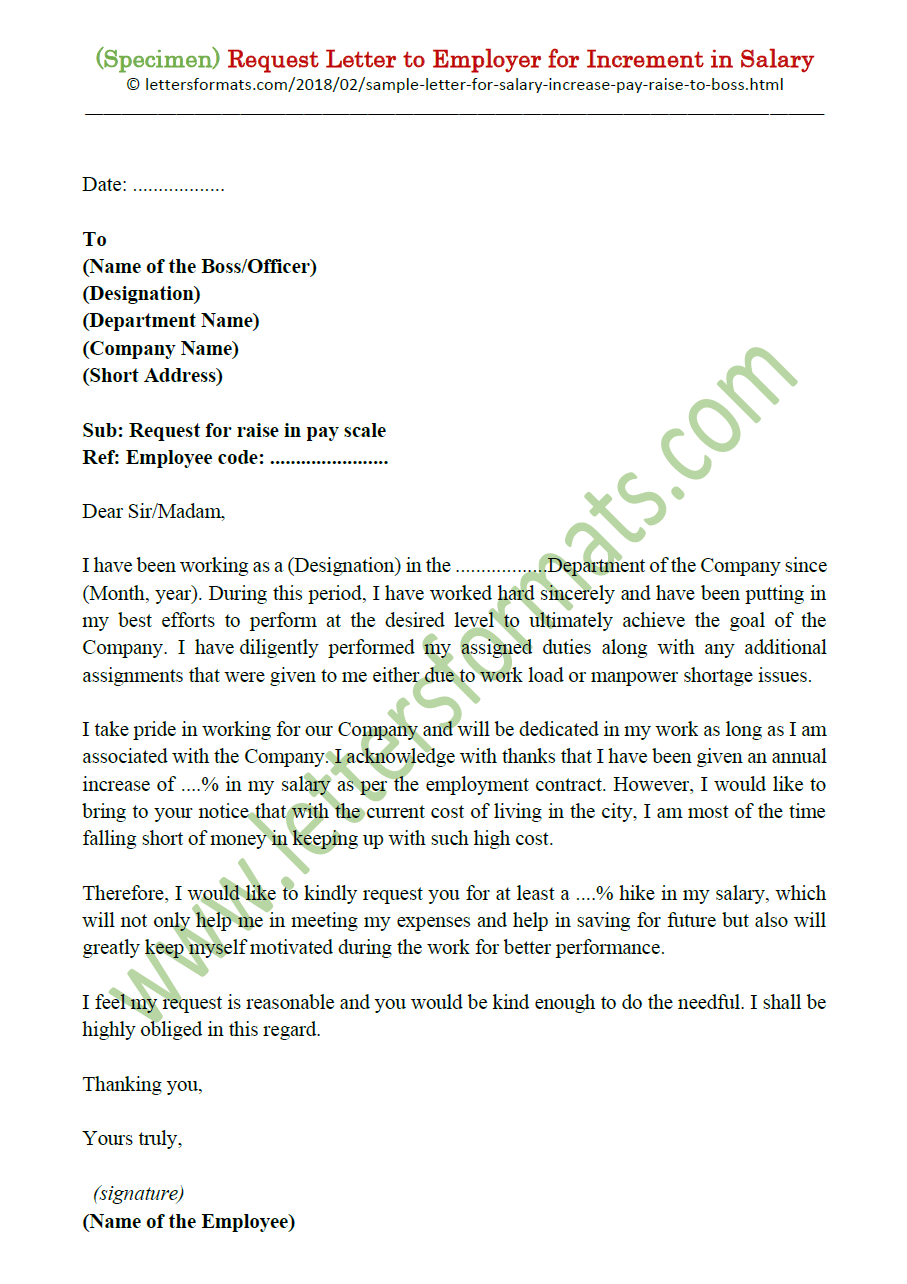

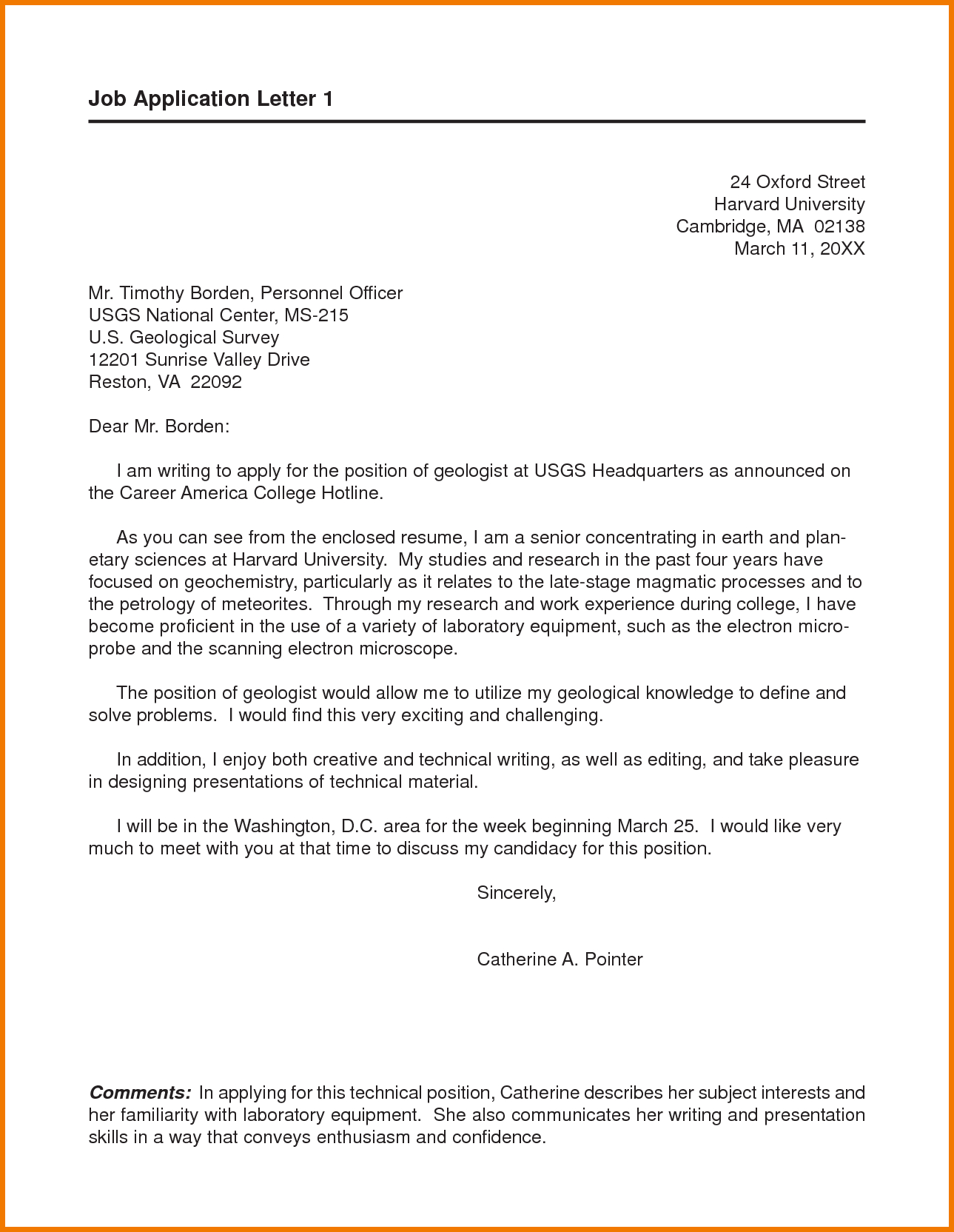

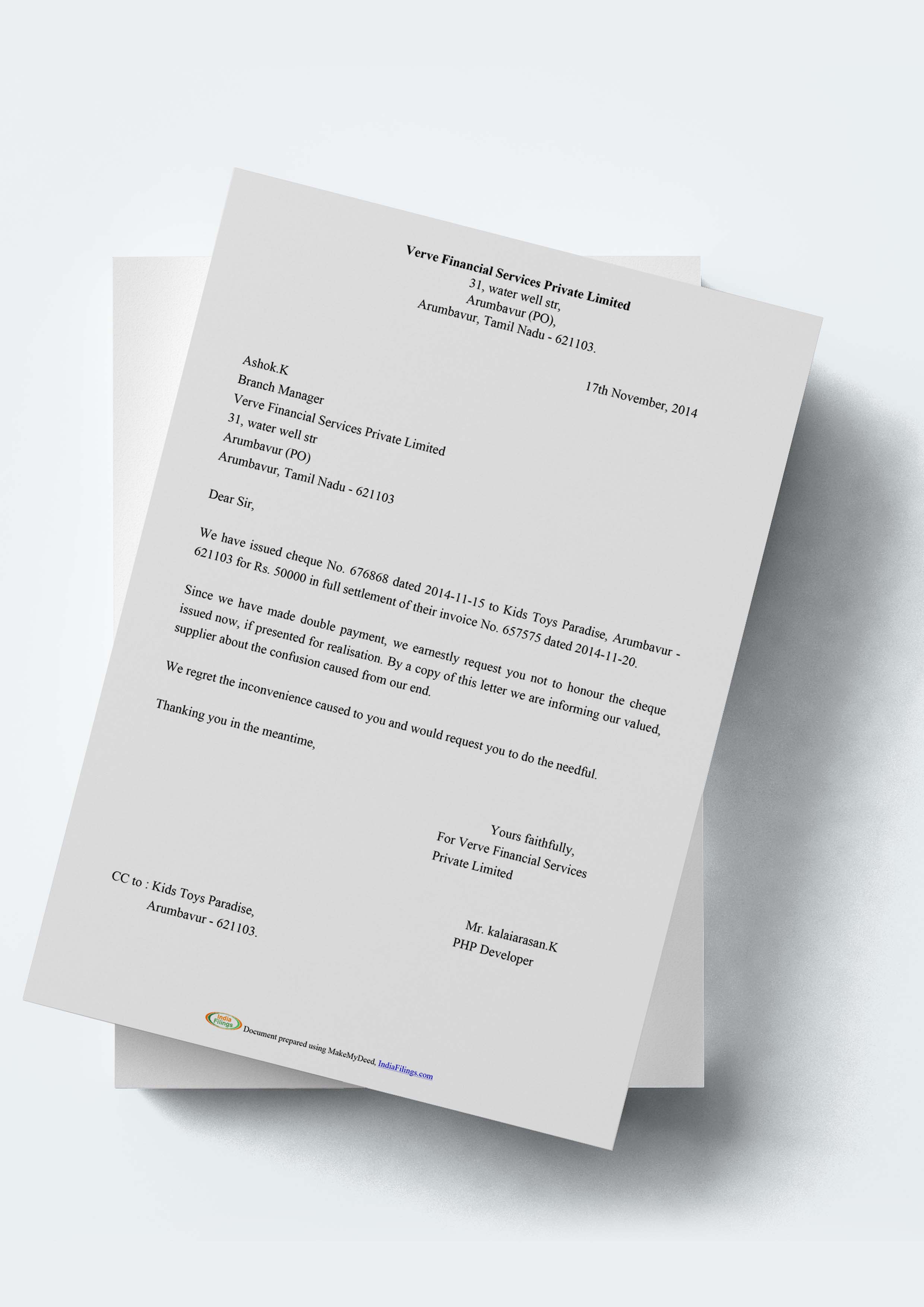

Letter For Stop Payment Of Cheque To Bank

Photo Credit by: bing.com / cheque semioffice

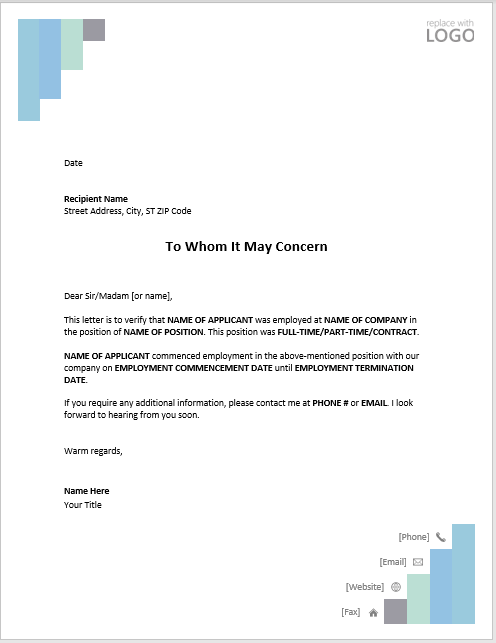

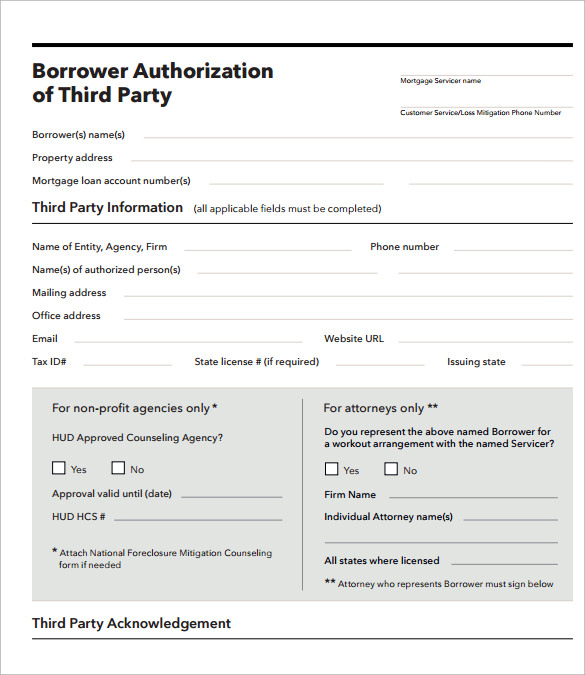

Cheque Stop Payment Letter – Legal Documents

Photo Credit by: bing.com / demand payment sample debt letter legal owing philippines template stop cheque stopped south africa canada forms document australia printable usa

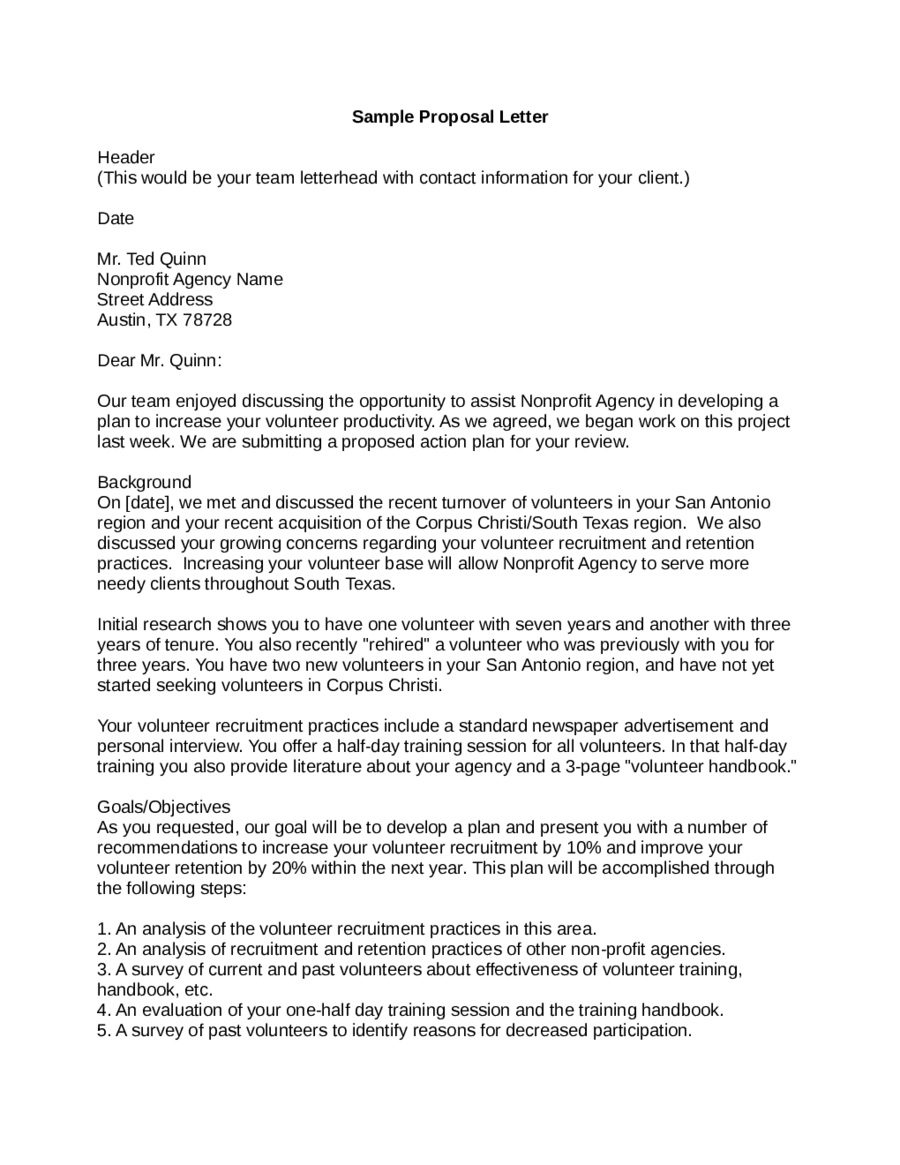

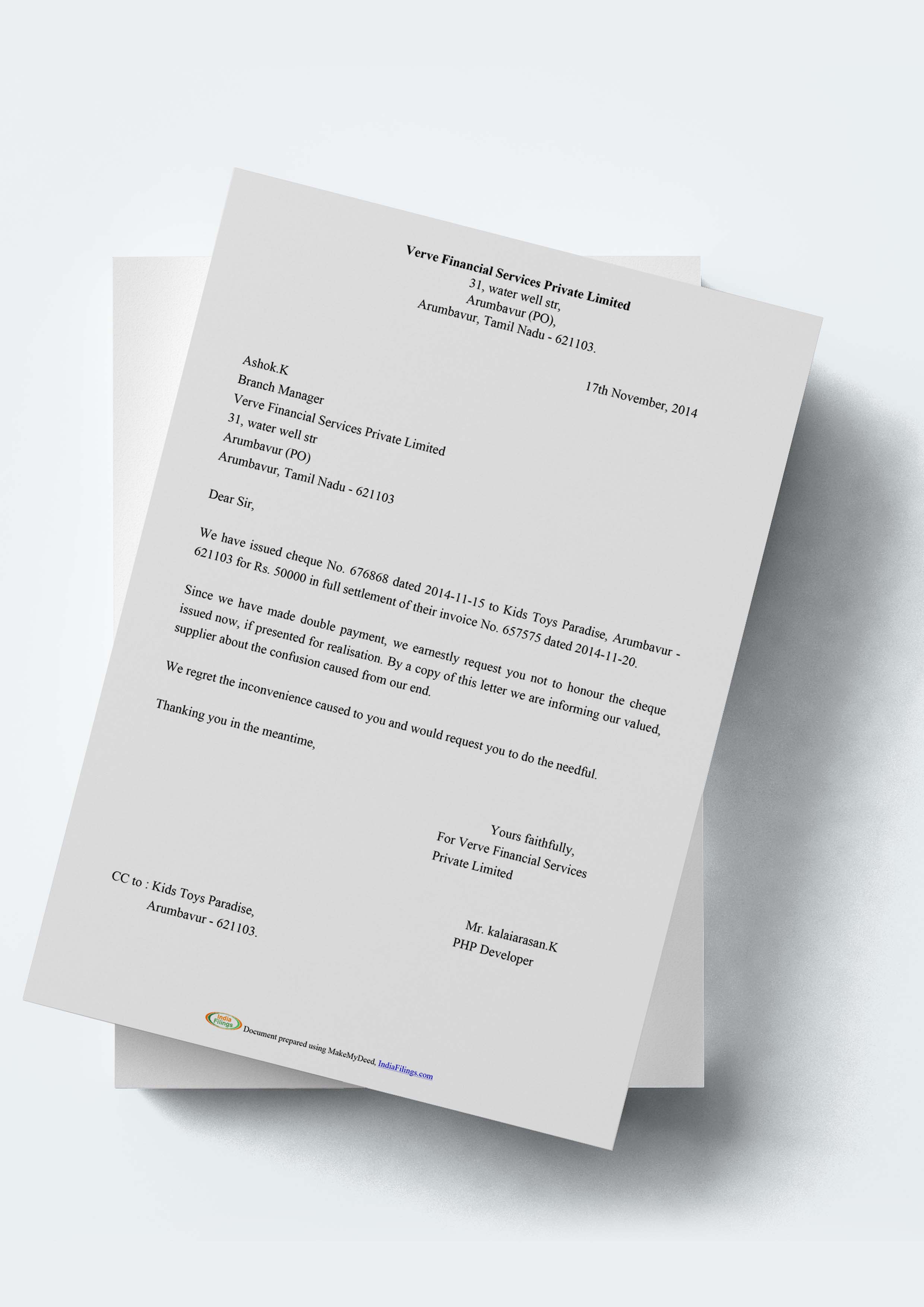

Stop Payment Letter To Bank Format In Word

Photo Credit by: bing.com / stop format letter payment bank word post

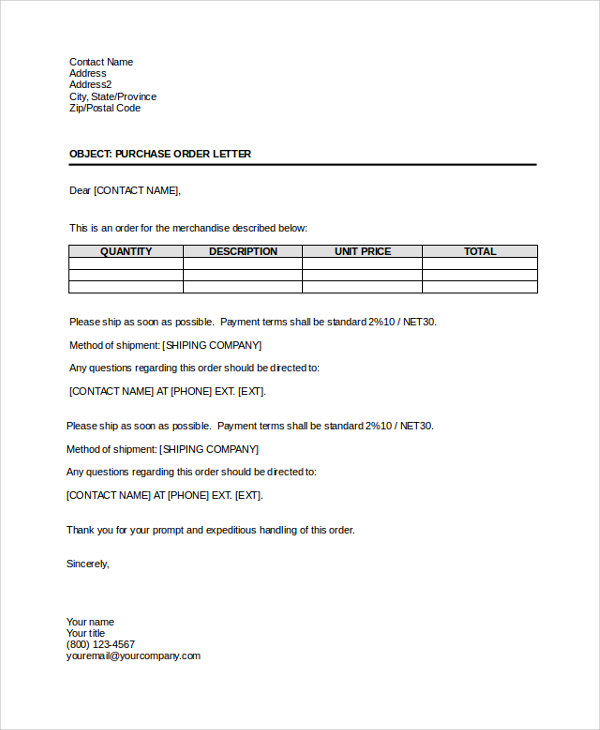

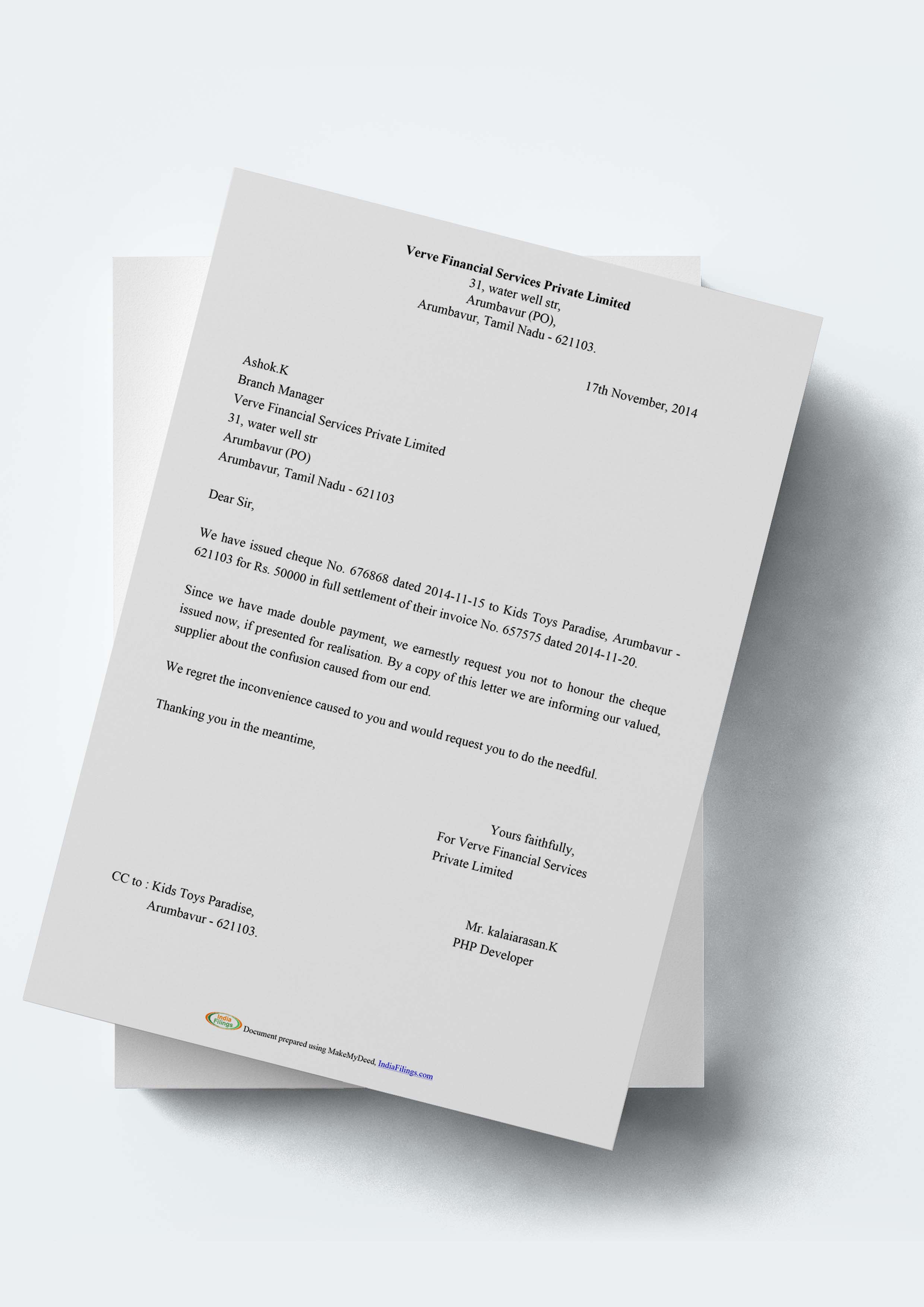

Cheque Stop Payment Letter Format And Generator

Photo Credit by: bing.com / cheque letter stop payment format bank

Letter To Bank For Closing Fixed Deposit FD Before/after Maturity

Photo Credit by: bing.com /